Finance Needs to Rethink Its Understanding of "The Business"

By Andy Burrows

It’s horribly dismissive, as well as being terribly cliché and old hat, to call us “bean counters” for working in the Finance department. Mere “number crunchers!”

Some go even further. One Marketing Director once tried to put us in our place by telling us that we in Finance were “just an overhead”. Apparently, Sales and Marketing brought in money, and everyone else, including Finance, just spent it. It seemed a source of some bitterness that he could work so hard bringing money in only to see it frittered away on our over-inflated salaries!

And so, why would anyone think to involve us in strategic discussion, let alone tell us about a new product before they launch it (thus avoiding the accounting mayhem we normally have to deal with!)?

And as a result, we’re made to feel like outsiders. We really want to be involved and valued, but instead feel shut out.

But, you see, sometimes we don’t help ourselves. Sometimes it’s the way we do things that leads them to think that way.

It’s not what you do... it’s not even the way that you do it

The mistake we make is that we can tend to do things in a way that holds our non-Finance colleagues at arm’s length.

What I mean is that we treat everything we do as a transaction, or as a process.

So, back in the day, when I was involved in monthly reporting, we used to send the cost centre managers “accrual forms”. They had to submit them to us by a deadline. We never told them why we needed them. Never really gave them much guidance. Never really spoke to them at all. It was just a form on an email. A procedure to follow. A box on a checklist. And we put their numbers straight into our journals. And that was that.

Nowadays, of course, we probably have workflow automation to make that much less clunky. But the principle is the same. The interaction is a transaction. We give them a form. They complete the form. We use the output.

We used to email their cost centre reports to them. They were our customers. That was the product we were providing.

And, many many people, including myself, have wrung our hands, and bemoaned that we never make an attempt to “add value”. But it’s not just that.

It’s why we do it – and we may not be seeing that right

What interests me is that the reason we do things that way is because of a very subtle flaw in our basic understanding of our relationship with the business, as Finance people.

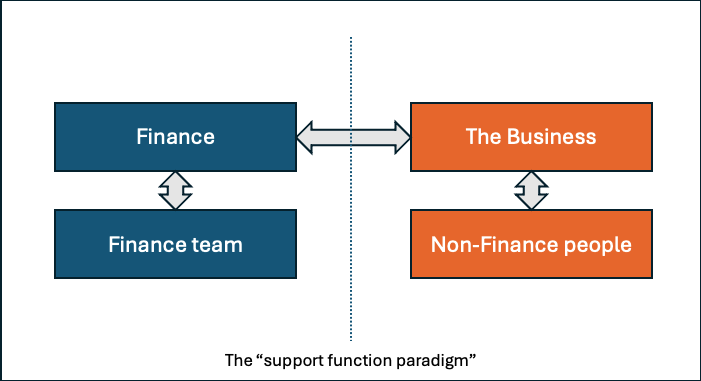

This flawed perspective is what I’d call the “support function paradigm”.

We tend to say that there’s Finance... and then there’s the business. Like, Finance is separate to the business.

That’s fundamentally why I don’t like the term “business partner”. There’s Finance, then there’s the business. Finance, which is not the business, can partner with the business.

And that leads us to thinking that our non-Finance colleagues are the business. And so, “helping the business” equates to keeping them happy, serving them, supporting them.

And there’s a lot that is helpful in that servant attitude. But, you see, they are not the business.

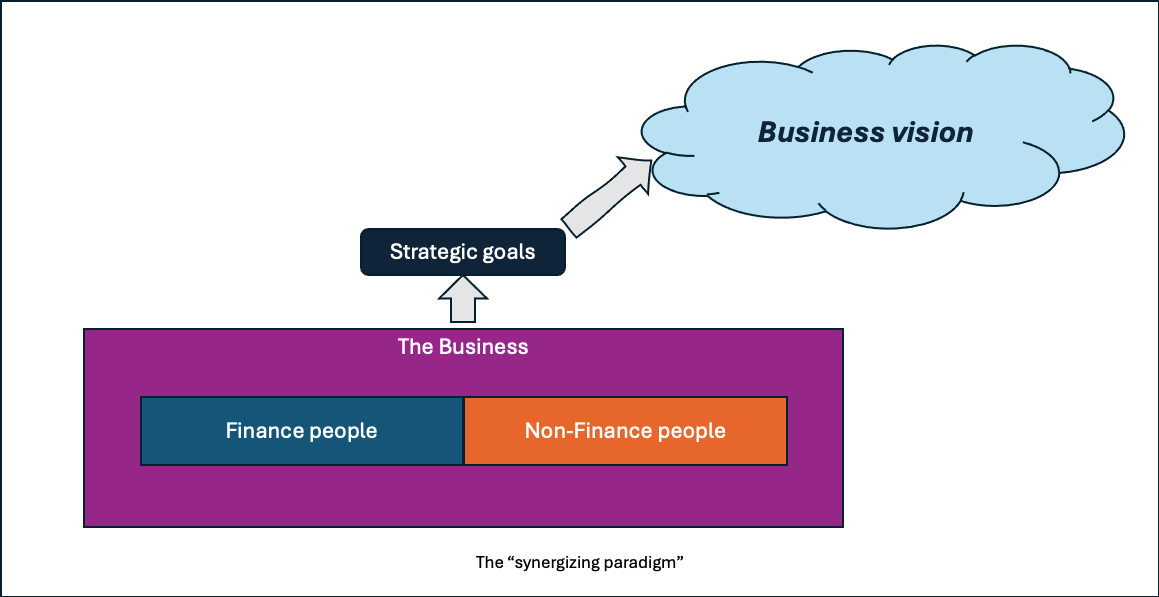

We – together - are the business. The business is an organisation set up around a shared purpose. And we in Finance are part of that. Our role is within the business, not outside of it.

Stephen R Covey said that, “an organization is nothing more or less than a relationship with a purpose... an organization is made up of individuals who have a relationship and a shared purpose.” (Stephen R Covey, The 8th Habit, p99)

A business, therefore, is a type of organization. And Finance people are part of that organization, and share the same purpose.

And, because I got this from Covey, I’m going to call it the “synergizing paradigm”!

But how does that change things?

Well, for a start, we realise that our role is directly involved in achieving the business mission and vision, alongside all our colleagues.

It’s not merely that other colleagues are out striving for the mission, and we are back home supporting them from afar. Ours is not a second-degree involvement. We don’t have a customer-supplier relationship with the rest of the business. It’s not that we supply the information and insight so that others can do the business of doing business.

Revisiting the ‘why’ of Finance – Business Performance Management

Have you ever considered who gets fired from the larger businesses when performance isn’t up to expectations?

Yes, the CEO...

... but also normally the CFO!

Why is that the case if Finance is merely a support function, an overhead, a messenger with information and data?

Investors clearly expect the CFO, and by implication the Finance function, to make a difference to business performance. And they have higher expectations of CFOs than of self-important Marketing Directors!!

I’ll give you an analogy later on that will help you understand why this is the case.

But first, let me briefly speculate as to how we may have arrived at the flawed “support function paradigm”.

Think of what happens as a business grows from being a very tiny one-person entrepreneurial enterprise, where the owner does everything.

One of the first things that business owner employs other people to do is the bookkeeping and the management accounts. And they do that, primarily, because they want to make sure they are compliant with tax regulations and company law. Recording transactions and preparing accounts is something they have to do by law. And when it starts taking up too much of their time, they get someone else in to do it.

And so, the “support function paradigm” is born right there, when the owner/CEO sees the Finance team as doing compliance/legal stuff to ensure other people in the business are free to go about making money without worrying about fines and legal claims (or running out of cash).

But what they don’t tend to realise is that even without the legal requirements, even if there were no tax (imagine that!), the business would not thrive without effective transaction recording and management accounting.

And that’s because the primary purpose of transaction recording and management accounting is performance management.

And then, as the business grows further, Finance grows with it, bringing in budgets, forecasts, analysis, controls, risk management. And those, too, are all to do with performance management.

CFOs are like soccer coaches

CFOs are like soccer coaches. (You may have heard me say this before. What can I say? I like the analogy!)

If you think about it, the head coach or manager of the team is the one that gets fired if the club owners don’t see the performance they want... and yet none of the coaching or management staff gets on the pitch to kick the ball.

The role of the coaching staff is performance management.

Finance is like the coaching staff of a soccer team, with the CFO as Head Coach.

We are in the business to ensure that performance is managed well. Because if you do better at managing performance, you’ll get better performance.

You need a framework for business performance management

I hope you can see that this isn’t just a subtle shift in terminology.

Finance is not a service provider to the business, or even a service provider to people outside of Finance. You don’t see soccer coaches sitting back just waiting to give reports to players who ask for them.

No! Soccer coaches are out with the team, working alongside them, explaining how they can improve performance, and drilling them to improve.

Finance should be more like that – working alongside people throughout the business, collaborating in initiatives that improve the performance of the business.

And to do that we need a framework of business performance management. And that’s what I talk about in my FREE White Paper – How Finance Can Drive Business Performance.

Why not download that now if you want to look into this more deeply?

Related Posts

Business-focused Finance is NOT the same as Finance business partnering

Business performance management for Finance professionals

CFO Readiness Builder

If you are keen to progress quickly in your Finance career, you need to focus on the skills and capabilities that make the difference. Our CFO Readiness Builder program is designed to help you to do that. CLICK HERE to find out more and register your interest.

About the Author – Andy Burrows

Qualified as a chartered accountant in the UK, Andy Burrows has worked for more than 25 years as a senior Finance professional in a variety of businesses of different sizes and sectors. He is now a popular writer in Finance and Accounting, and provides online learning and coaching to help Finance people become better at helping the businesses they work for. In 2019 he was described as one of the "Top voices on LinkedIn for Finance, accounting and FP&A".

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates on new resources to help you make your Finance role add value in the business you work for

[Your information will not be shared with external parties for anything other than the provision of Supercharged Finance products and services.]